AI-Powered Expense Classification with Lodge Pro

At Lodge Pro, we know that tax time can be overwhelming, especially when it comes to categorizing expenses accurately and in compliance with Australian Tax Office (ATO) guidelines. That’s why we’ve developed an AI-powered classification system that automatically categorizes your expenses into the correct tax deduction labels. Whether you upload bank statements manually or use our seamless Open Banking integration, our AI ensures that your tax filing process is streamlined, accurate, and stress-free.

How AI Expense Classification Works

- Seamless Integration with Open Banking

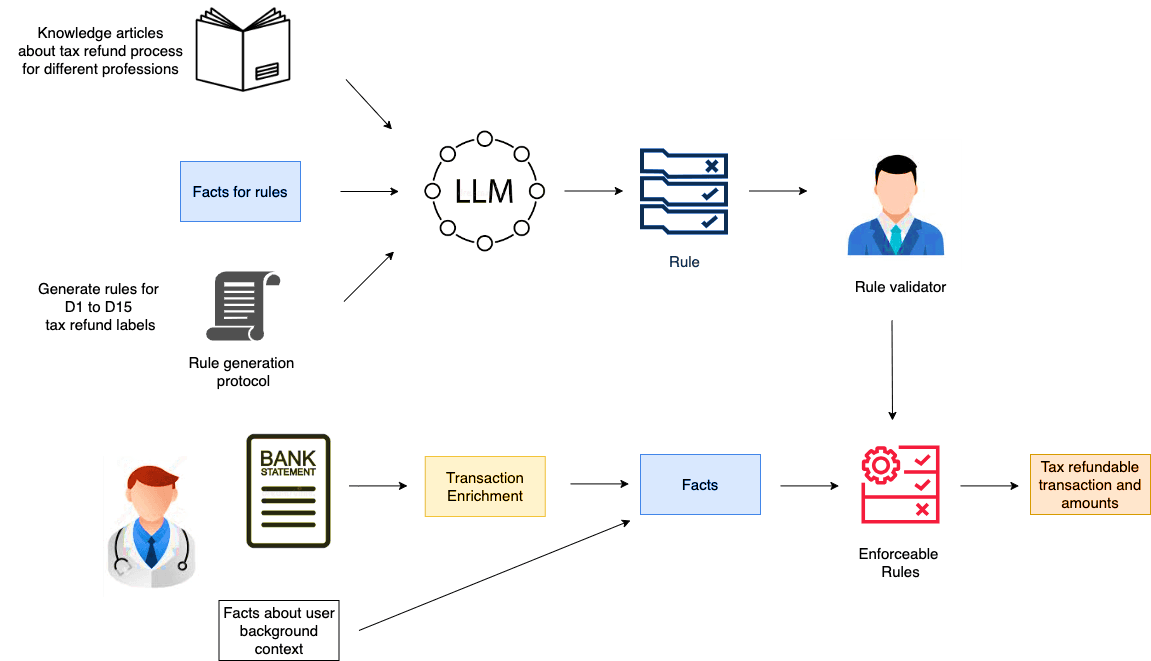

Lodge Pro securely connects to your bank accounts through the Open Banking platform to retrieve your transaction data. Our system uses a hybrid AI approach, combining advanced machine learning with predefined tax rules to ensure each transaction is categorized correctly. Using Large Language Models (LLMs), Lodge Pro automatically updates tax classification rules based on the latest tax regulations, ensuring your deductions are always compliant. - Manual Bank Statement Uploads

Prefer to upload your bank statements manually? Lodge Pro’s AI processes your uploaded documents, extracting transaction data and categorizing each expense according to the relevant tax deduction labels. This saves you time and ensures that no eligible deductions are missed. - Accurate Deduction Classification

Lodge Pro’s AI automatically categorises your expenses using deduction labels that are aligned with ATO standards, ensuring they’re matched to the correct tax return categories. As tax regulations evolve, Lodge Pro’s AI adapts automatically, updating its rules in real-time to reflect the latest changes in tax law. This ensures that your deductions are always up-to-date, accurate, and compliant without the need for manual adjustments. Here is a list of deduction categories Lodge Pro can automatically classify,- Car Expenses, Parking & Tolls

- Travel Expenses

- Laundry Expenses

- Education Expenses

- Books & Other Work-Related Expenses

- Low-Value Pool

- Interest Deductions

- Dividend Deductions

- Gifts & Donations

- Cost of Tax Affairs

- UPP of Pension or Annuity

- Personal Superannuation Contributions

- Project Pool

- Forestry Managed Investment Scheme

- Other Expenses

Explainable AI for Transparency

Each classification comes with a detailed explanation, ensuring full transparency. Lodge Pro’s Explainable AI not only shows why a transaction was categorized under a specific label but also provides traceable and auditable decisions, giving you confidence that your deductions comply with Australian tax laws. Our system is reviewed by tax professionals to guarantee both legal and ethical compliance, so you can file your taxes with peace of mind.

Key Features of Lodge Pro's AI Classification

Feature | Benefit to You |

|---|---|

| Real-Time Expense Classification | Transactions are classified instantly after retrieval, saving time and ensuring accuracy. |

| Explainable AI | Understand how and why your expenses are categorized to ensure transparency and confidence in the system. |

| ATO-Compliant Labels | All deduction labels follow ATO guidelines, ensuring compliance and minimizing the risk of audits or penalties. |

| Profession-Based Classification | The AI adjusts for specific professions, ensuring that your deductions reflect your unique tax needs (e.g., nurses claiming uniforms). |

Lodge Pro’s AI is continuously fine-tuned to provide the most accurate classifications. Our team of tax professionals regularly reviews the AI-generated classifications to ensure that every deduction meets legal and ethical standards. This human oversight guarantees the highest level of compliance, accuracy, and accountability, so you can file your tax return with complete confidence.

How to Use Lodge Pro’s AI Classification

- Link Your Bank Accounts

Use Open Banking to securely link your bank accounts. Our AI will automatically retrieve and classify your transactions in real time. - Upload Bank Statements

Prefer not to use Open Banking? Upload your bank statements manually and let Lodge Pro’s AI classify the transactions for you. - Review & Confirm

Once your transactions are classified, review and confirm each deduction. - Explainable AI feature provides clarity on why each expense was categorized, allowing you to make informed decisions before filing your tax return.

Why Choose Lodge Pro’s AI-Powered Classification?

- Save Your Time: Our AI handles all expense categorization automatically, so you don’t have to spend hours sorting through transactions.

- Increase Accuracy: Minimize the risk of human error and ensure that every eligible deduction is captured.

- Ensure Compliance: Lodge Pro’s AI is built on ATO guidelines, helping you stay compliant with tax laws and reduce the risk of audits or penalties.

- Full Transparency: With Explainable AI, you can see exactly why an expense was categorized the way it was, giving you full control over your tax return.

Getting Started with Lodge Pro’s AI Classification

Filing your taxes has never been easier. Start today by linking your bank accounts or uploading your statements, and let Lodge Pro’s AI-powered system handle the rest.

Ready to take control of your tax return? Sign up/Login now and experience the simplicity and accuracy of AI-powered tax classification.

Subscribe to our weekly newsletter!

Tax breaks in your inbox! Subscribe now.

You can easily unsubscribe from future emails at any time.

Compare us with!